Welcome back to Crescendo Insights, where we provide a bite-sized piece of monetization strategy each week.

If you’re not a subscriber yet, hit the button below to keep getting these emails delivered to your inbox.

The BLUF (Bottom Line Up Front)

Competitive research is both distracting and dangerous for setting prices.

The best way to set prices is with primary research and data analysis. We show how it can fly in the face of what competitors are doing (often because they’re wrong).

If you have to do competitive research, do it in interviews. We show you how.

“Competition is for losers” - Peter Thiel

Whatever you think about Peter Thiel these days, his book Zero to One has been highly influential in the way people talk about company building. In the book, Thiel devotes a whole chapter to why focusing on competitors is often distracting when building startups. I feel the same way about pricing.

Competition, while theoretically important, gets far too much airtime in people’s discussions of price. In fact, it’s so irrelevant, that we at Crescendo employ a “skimming strategy” with regard to benchmarking competitors1. It’s not that it’s irrelevant, it’s that thinking about competition is incredibly distracting.

Competitors are distracting

Let’s go back to last week’s post on costs, and why they are similarly unimportant. Remember my super special Magic 8 Ball2 that tells you the willingness-to-pay in a market? Let’s say we survey our customers (or look into the 8 Ball) and learn that we have the exact same demand curve as we had last week for my “premium newsletter”:

Customer | Willingness-to-Pay |

A | $9.00 |

B | $8.00 |

C | $7.00 |

D | $6.00 |

E | $5.00 |

F | $4.00 |

G | $3.00 |

H | $2.00 |

I | $1.00 |

Now I introduce a new piece of information - some competitive intel!!!

Stratechery, by Ben Thompson costs $150 per year or $12.50 per month

Lenny’s Newsletter by Lenny Rachitsky costs $200 per year or $16.67 per month

Letters from an American by Heather Cox Richardson costs $50 per year or $4.17 per month

Given that new piece of juicy information, how should I price Crescendo Super Premium3?

Still 👏 At 👏 Five 👏 Dollars 👏

Why? Because I already told you what people were willing to pay for my newsletter. Their willingness-to-pay takes substitutes into account. The market is saying “Ian’s fake newsletter is slightly more valuable than Heather’s, but not as valuable as Lenny’s”4. That’s exactly why the optimal price was $5.

Case Study: Competitors are dangerous

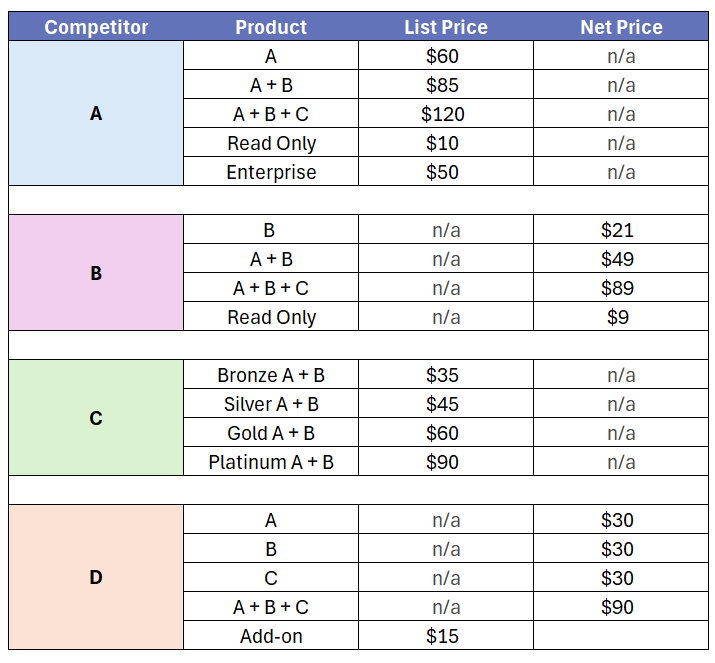

Occasionally, Crescendo will work with companies that are large enough to have entire departments devoted to competitive research. While I don’t usually think this is a good use of money, it does provide me with some fodder for case studies like this.

Below I’m going to show you real data from a client that had truly excellent competitive intel.

So what’s the right way to price and package? If you’re smart5, you should have no idea. Let’s go through why.

Issues with the Competitive Research Above

Prices range from $21 per user all the way to $120. I shouldn’t have to help you do the math, but that’s what we call “statistically large”.

Blue’s base package includes product A and upsells B, while Pink’s has product B in the base and upsells A. Which bundling framework is correct?

Blue and Pink have traditional tiers (Good-Better-Best) for packaging, while Green has a variant where the products remain constant but get more powerful. Orange is different too, with full a la carte packaging. Which packaging is correct?

Blue and Pink sell read-only users while the other two do not. Should we have 2 price metrics or just 1 metric / type of user (or more)?

In no situation do we have both the list price and the net price, yet our client routinely discounts around 55% and up to 70%. Should we assume that the competitors do too?

If you’re as confused as I was, you’re learning how useless competitive research can be. Let’s just take 1 of those questions above - the question of price level. As you can see, the prices range from $21 per user to $120 per user.

POP QUIZ! How much should we charge?

A) $45 (the mid point)

B) $51 (the average)

C) $60 (the “finger in the air price”)

D) Something else

Go ahead and guess……………..

Before I tell you the answer, let me give you ONE MORE piece of information. The graph below, generated from a quant study we did with our client’s customers. The purple curve is the demand curve (volume at different price points) and the red curve is the projected revenue at each price point.

Now how much should we charge?

If you said $120 (because you looked at the graph), you’d be right. Imagine if we had cut our prices to $45 or even $60. The results would have been disastrous.

In case you’re wondering, other data analyses revealed the following:

We needed a hybrid packaging between Blue and Orange, with some tiers and some a la carte.

Pink definitely got the bundling wrong

Green’s packaging wasn’t flexible enough for customers and led to frustration with forced upsell.

Two types of users were the preferred price metrics. For what it’s worth, our client started with 3 types, but we found that the willingness-to-pay for two of the user types was the same.

How to actually test for competitive pricing

If you can tell, I’m not a fan of competitive benchmarking. But if you’re really curious, I like to use customer interviews to simulate actual bakeoff scenarios:

Start by asking the competitive set: “who did you compare us to?” 99% of customers will volunteer that information.

After asking customers about their selection criteria, ask how you compared, relative to the other competitors, especially with regard to price.

Ask if there were any special deal considerations, discounts, or negotiations.

You would be amazed how many customers will volunteer that information. As an example, here are a few real quotes from customers:

[Competitor] was lower, but not significantly enough. Maybe 15% - 25%. But their service was so bad! It was very clear that they were trying to undercut [client].

[Client] was significantly cheaper than [competitor]. Like hundreds of thousands of dollars cheaper, with more features.

[Client] and [competitor] are essentially the same price. It’s just not worth it to switch.

Get in touch

Crescendo works with medium-sized software companies to improve their pricing, packaging, and promotion strategies. If you’d like to book a quick consult, reach out at [email protected] or schedule time via the button below.

1 If you know what a skimming strategy is, you should know not to call us about benchmarking competitors

2 Patent pending

3 Name TBD

4 Probably true, even though I made up that willingness-to-pay data

5 And you are because you’re reading this newsletter