Welcome back to Crescendo Insights, where we provide a bite-sized piece of monetization strategy each week.

If you’re not a subscriber yet, hit the button below to keep getting these emails delivered to your inbox.

The BLUF (Bottom Line Up Front)

People overly focus on costs when determining optimal prices, when in fact, fixed costs don’t matter at all and variable costs barely matter.

Variable costs start to matter at 60% - 50% gross margins, and even then, they don’t matter that much.

Fixed costs only matter for calculating “pricing leverage,” or how powerful pricing is as a lever in your business.

Focusing on what matters

We’re back baby! After a bit of a hiatus, we’re back with some weekly pricing content. I know you missed me. For the next few weeks, we’ll be covering 3 topics that most people think are important in pricing but actually matter a lot less: your costs, your competitors, and your ROI.

Before we get started, I have a quick disclaimer. I’m going to repeat this disclaimer 3 times, so you might as well listen to it now:

YOUR COSTS / COMPETITION / ROI SOMETIMES MATTER. But they don’t matter as much as you think…

Let’s dive in.

Why do we focus so much on costs?

In a word, it’s easy. If the goal of (most) business is to make a profit, knowing your costs at least lets you know whether you are pricing high enough.

The problem is that focusing on costs is either irrelevant or dangerous. Let’s do some math.

My pricing Magic 8 Ball

Imagine that I have the world’s coolest Magic 8 Ball. It doesn’t answer yes or no questions - instead it tells us exactly what people are willing to pay for any product or service. Let’s pretend I’m selling a subscription to my new fancy pricing newsletter. I’m going to price it between $1 and $10 per month, and my Willingness-to-Pay Magic 8 Ball gives me the following information about my market.

Customer | Willingness-to-Pay |

A | $9.00 |

B | $8.00 |

C | $7.00 |

D | $6.00 |

E | $5.00 |

F | $4.00 |

G | $3.00 |

H | $2.00 |

I | $1.00 |

What’s the optimal price? Just by looking at the numbers above, you should be able to see that it’s $5. At $5, the top 5 people buy, and we make $25. $4 and $6 would be too cheap and too expensive.

Customer | Willingness-to-Pay | $6 Price | $5 Price | $4 Price |

|---|---|---|---|---|

A | $9.00 | $6.00 | $5.00 | $4.00 |

B | $8.00 | $6.00 | $5.00 | $4.00 |

C | $7.00 | $6.00 | $5.00 | $4.00 |

D | $6.00 | $6.00 | $5.00 | $4.00 |

E | $5.00 | $5.00 | $4.00 | |

F | $4.00 | $4.00 | ||

G | $3.00 | |||

H | $2.00 | |||

I | $1.00 |

|

|

|

Total | $45.00 | $24.00 | $25.00 | $24.00 |

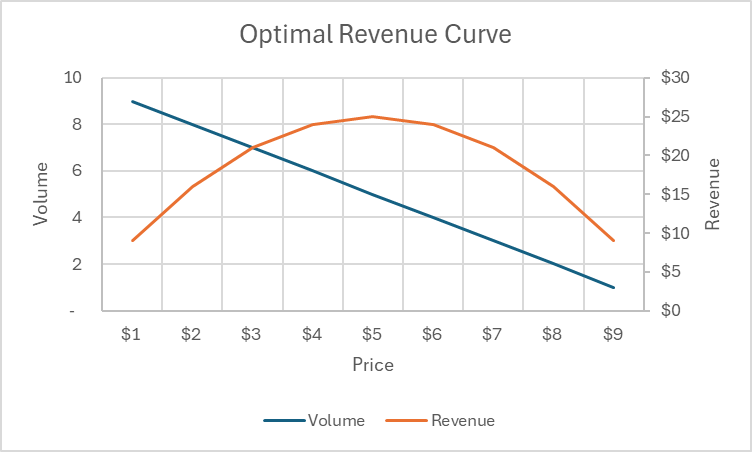

You also could have broken out some high school calculus if you realized that the demand curve was linear and followed the following equation: y = 10-x or Volume = 10 -Price. That lets you do the math below:

Revenue = Price * Volume

R = P * (10 - P)

R = 10P - P2

Now take the derivative and set it equal to 0, like you did in calc 1

0 = 10 - 2P

2P = 10

P = $5

If you’re wondering how often I do derivatives for clients, let’s just say that the answer is not zero times. Anyway…

The curve below shows you how much revenue you would make at different price points. Obviously, the optimal point is at $5.

Fixed Costs

Fixed costs are costs that do not change with the number of customers you have. These are things like rent, accountants, paper clips, and the CEO’s salary. On an income statement, we usually lump everything in SG&A + all R&D expenses into fixed costs. The one exception to this rule is sales and marketing spend, which we view as a variable cost. Sales commission and direct marketing spend are more clearly variable costs, but even salaries tend to scale with customer count in large enough businesses.

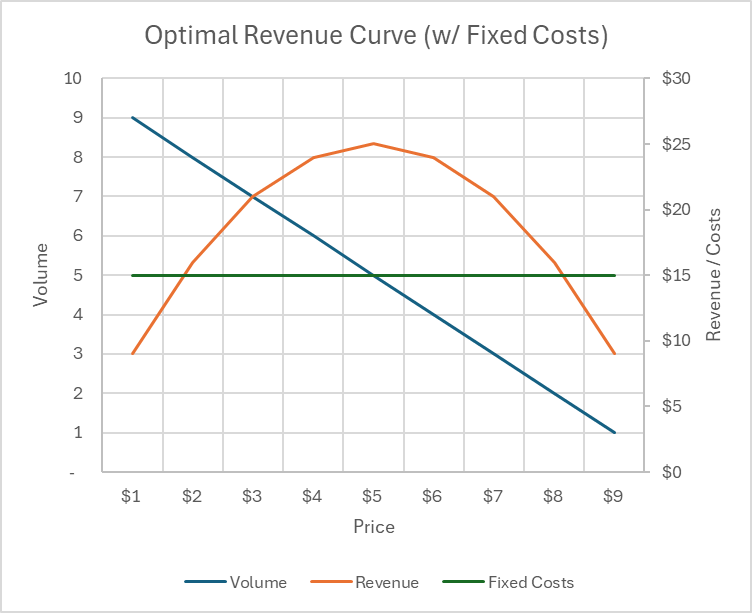

Do fixed costs matter in finding the optimal price? No.

Let’s say it costs me $15 per month to make this newsletter. Does the optimal price change from $5? It does not. In fact, fixed costs have no effect at all on your optimal price, other than perhaps to tell you that you have a very bad business.

Obviously my fixed costs cannot exceed $25 or I will have an unprofitable business. It should be obvious, but the distance between the orange line above and the green line represent your profit, which is still maximized at $5.

Variable Costs

Variable costs are costs that scale with the number of customers you have. Most commonly this is Costs of Goods Sold (COGS), like hosting fees or services, but we also like to include sales & marketing expense as a part of variable costs.

Do variable costs matter in setting the optimal price? Kind of.

In order for variable costs to matter, you need 2 things to be true:

Your company has to be optimizing for profit, specifically gross profit, rather than revenue

Your variable costs have to be in the range of at least 40% - 50% of revenue

For most software companies, that last point is a non-starter. Very few software companies have 50% gross margins, or if they do, they really need to call us for some pricing help.

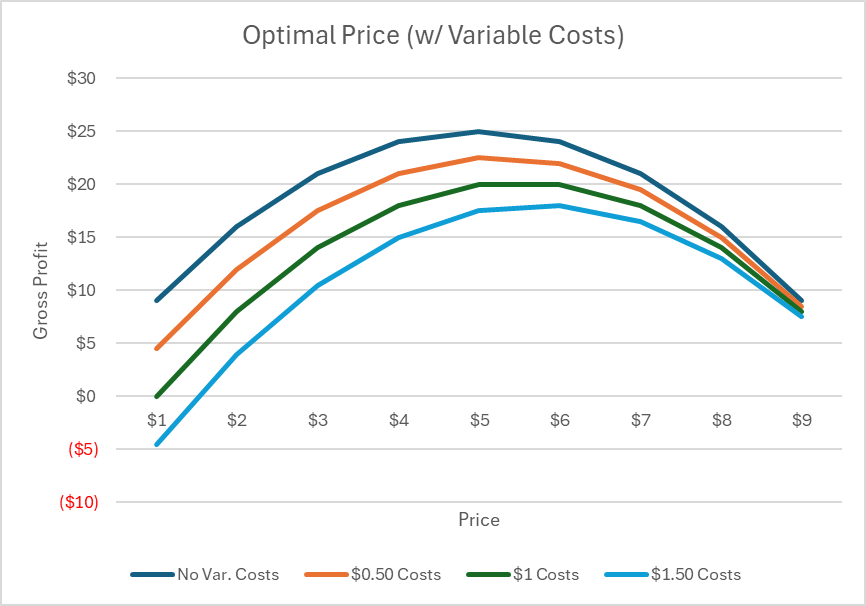

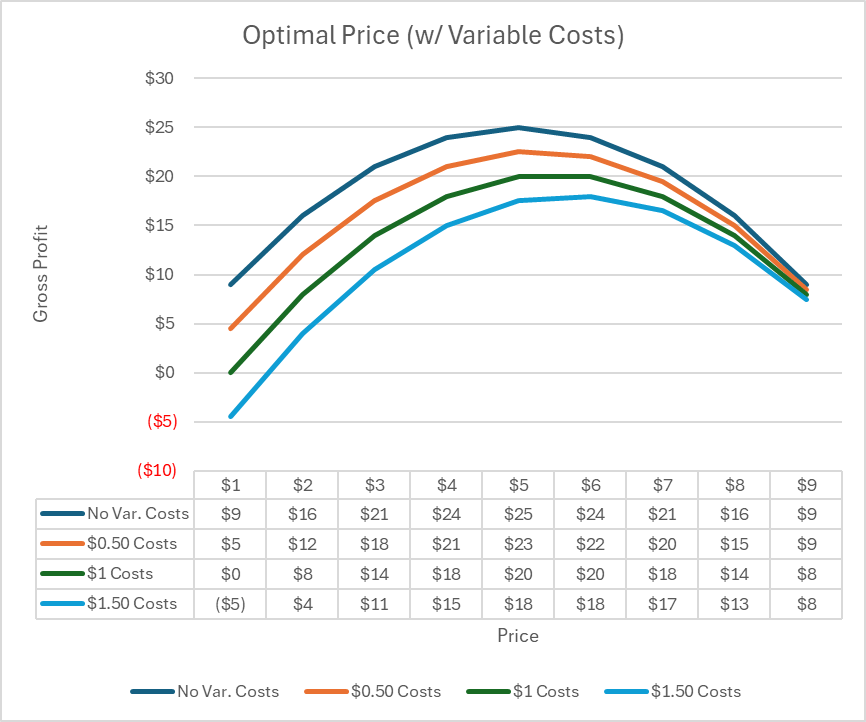

Let’s look at the math. Below is a graph that shows how the optimal price curve shifts down and to the right as our variable costs go up. But even at 30% costs ($1.50), our optimal price barely changes from $5 to $6. Furthermore, the total profit at risk of getting it wrong by $1 reduces from 4% (@ no variable costs) to 2.8% (@ $1.50 variable costs).

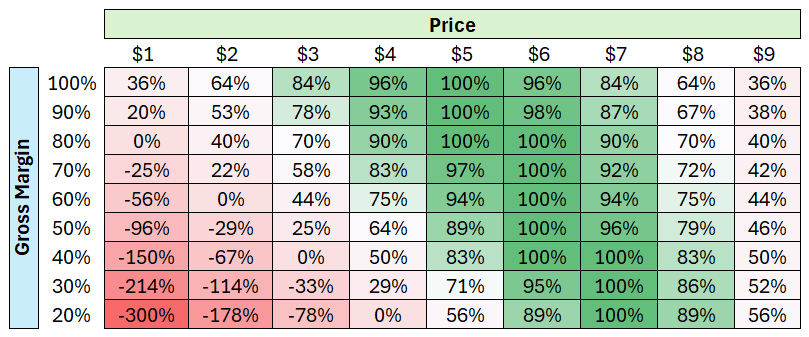

Here’s another way to look at it. At what gross margin does the profit optimal price meaningfully differ from the revenue optimal price? Remember - the cell represents the % of maximum profit you could achieve.

You may notice that while the numbers technically start to diverge immediately, the difference is too small to be meaningful. In fact, given that our pricing knowledge is likely off by ~10% anyway, optimizing with or without costs is often false precision.

So when do costs actually matter?

Not often, but it does happen.

First of all, costs matter whenever your gross margins are around 50%. For most of our clients, that rarely happens, but certain products or service lines can easily dip to ~50%. Maybe you’re reselling a product and your royalty fee is quite large? Or maybe your AI engine is super expensive? Those would be times where you’d want to look at costs. This happens most commonly with professional services that are sold alongside software.

The second time they matter is when costs change your go-to-market strategy. On occasion, we will advise clients to adopt a “skimming strategy,” or a strategy that optimizes for profit by deliberately sacrificing revenue. You might want to do that to push customers away from certain products or to jettison certain customer segments that are either less profitable or strategically unimportant.

Lastly, we care about fixed costs only when calculating pricing leverage. Pricing leverage is a topic we’ll explore in another post, but it’s a calculation of how powerful pricing is as a lever in your business. You can think of it as the ratio between change in price and change in profit. If you want some algebra homework, try deriving the formula for the change in EBITDA (at a revenue neutral churn rate), given 3 variables: price change, variable costs, and fixed costs.4

Get in touch

Crescendo works with medium-sized software companies to improve their pricing, packaging, and promotion strategies. If you’d like to book a quick consult, reach out at [email protected] or schedule time via the button below.

1 I mean…maybe I should do that

2 Not a real footnote

3 Patent pending

4 Or email me for the answer